Running a successful business in Ajman Media City Free Zone includes a certain amount of number crunching and staying ahead of the number game.

Small businesses in UAE are realizing this need now, more than ever, because of the recently enforced law of complying with VAT related regulations. The results of a recently done survey have revealed that nearly two hundred businesses are struggling with the accounting aspect of their business.

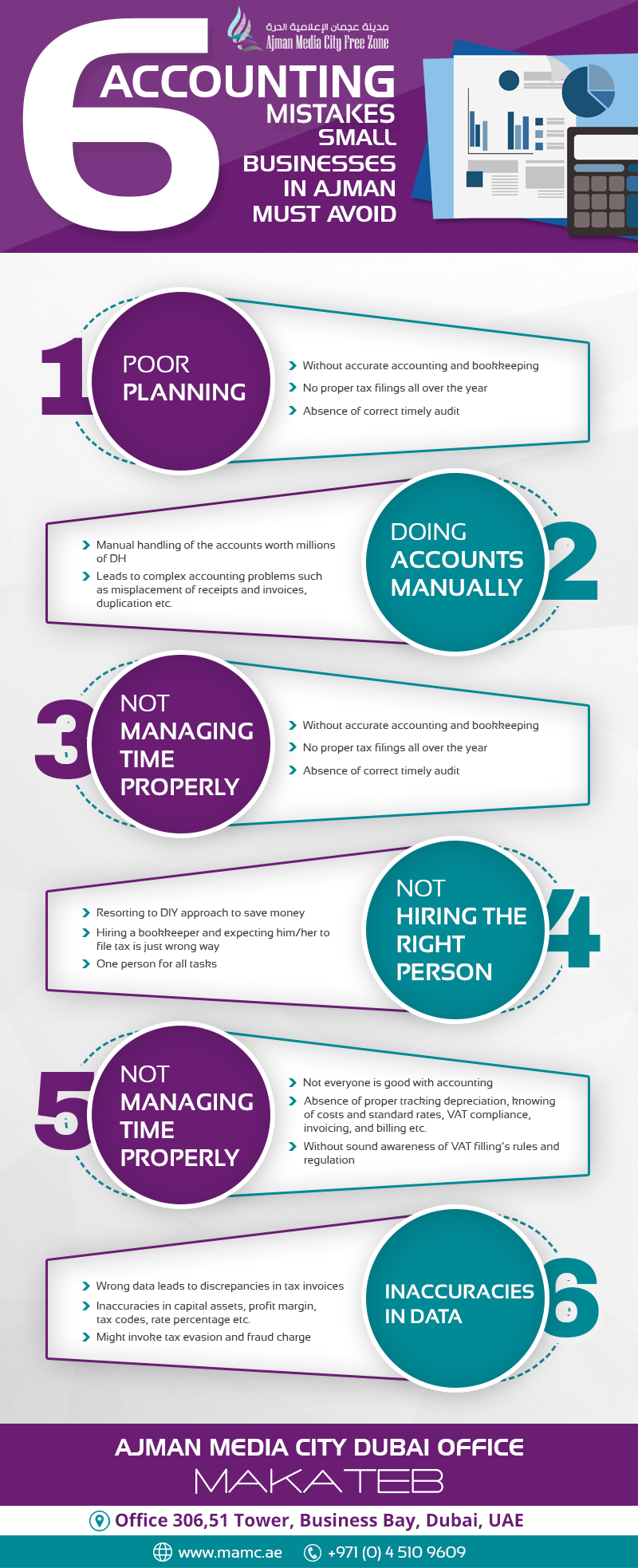

Following are the top six crucial accounting mistakes small businesses are currently making:

Being Ill-planned

As per the new law, small businesses now need to have proper account books and get them audited and file tax returns at the end of the financial year. In the day-to-day challenges of running a business, SMEs often end up ignoring the need to strategize and plan. Also, even the best of the accounting software are of no use if one is lagging behind in the timely input of data.

Doing Accounts Manually

While there has been a lot of technological advancement in the accounting field, many of the SMEs with net sales under 2,000,000 DH are still handling accounts the old way, which is compounding their accounting problems. This is one major reason behind the errors, oversights, misplacement of receipts and invoices and duplication in accounts.

Not Managing Time Properly

Time is as precious as money for small businesses. Lack of planning and paying attention to the wrong aspects of business wastes a lot of time. Sticking to manual record-keeping, billing, and inputting of data by hand are some of the tedious and time-consuming practices that keep the staff over-occupied.

That’s why many SMEs in UAE end up landing in hot water near the end of the financial year just because they were too preoccupied to pay attention to the VAT filing date.

Not Hiring the Right Person

Going for a DIY approach to cut costs is not always prudent for a small business owner. Not hiring the right person for the job is an even bigger issue. For instance, expecting a bookkeeper to do the accountant’s job or file your taxes, manage your company’s operating budget or forecast sales projection can lead to major issues.

Lack of Knowledge

Not every person running a business has sound accounting knowledge or a good grasp on numbers. Accounting management includes various aspects, such as tracking depreciation, knowing the cost of units sold and the standard rate, maintaining a chart of accounts and balance sheets, value-added tax (VAT) compliance, invoicing, billing, and inventorying.

On top of all this, one also needs to have a sound knowledge of finance, the accounting regulations and procedures of UAE and VAT filing, and practical experience of accounting software.

Inaccuracies in Data

Missing information or miscalculations and wrong data input leads to discrepancies and preparation of invalid tax invoices. Some examples of these inaccuracies are: Wrong calculation for capital assets, discrepancies in the profit margin, inadequate tax codes, incorrect rate percentage, submitting insufficient evidence for VAT reclaims, etc. Remember, these inaccuracies may lead to getting levied with tax evasion and fraud charges.

Ajman Media City Free Zone is the ideal place to start your small business or startup because of its simple business set up requirements and procedures. We at Makateb can help you establish your business. Business consultancy in UAE Ajman Media City Free Zone in a swift and hassle-free manner.