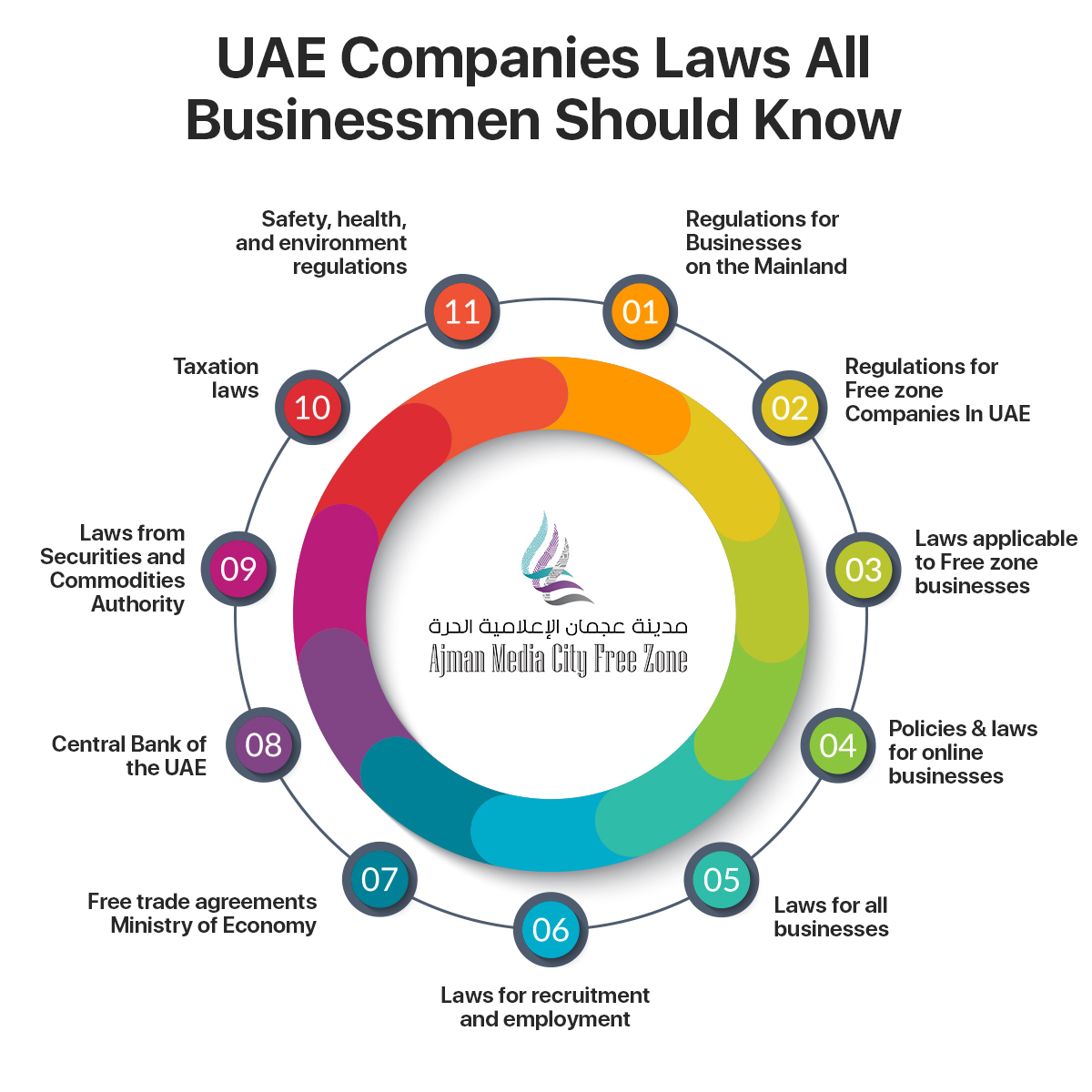

Companies in UAE ,Every country has their own set of laws and regulations for businesses to comply with, other than the international standards set for business and trade. UAE is no different.

Although, UAE has comparatively more relaxed rules when it comes to business, to attract foreign investment in the country. Nonetheless there is a set of requirements that needs to be fulfilled to establish a business. A lot of start ups are springing up in Ajman Media City Freezone which will have to follow the regulations not only in the country’s laws, but also those set forth by the freezone authority. This involves a lot of important decisions and extensive paperwork.

Procuring a license in UAE for any sort of business or trade activity, whether it is to open a coffee shop, a branch of an international bank, or an eCommerce store, is perhaps the most difficult step in establishing a business. Licenses in the UAE are issued on the basis of the type of company (LLC, joint venture, etc.) and the location of the office (i.e. mainland like on Burj Khalifa or freezone like Ajman Media City Freezone). In some cases, a license cannot be secured if there isn’t a local sponsor.

Regulations for Businesses on the Mainland

UAE Federal Law No. 2 of 2015 on Commercial Companies covers all economic entity which practices any commercial, industrial, financial, real estate, agricultural or any other kind of economic activity taking place on the mainland except:

- Companies that are excluded in the UAE Cabinet’s resolution

- Companies owned by local or federal governments

- Companies operating in the gas, power and oil sectors, 25% of the ownership of which is geld by the local or federal government

Regulations for Freezone Companies In UAE

The governance of such businesses falls under the free zone authority in and in some cases by some other government entity. Also, laws that are specific to the nature of your business might further affect your business activity.

Laws applicable to Freezone businesses

All general business/commercial laws, except for Federal Law No. 2 of 2015, which focuses on Commercial Companies in uae Law.

Other laws that might affect such businesses are those that are specific to your business activity such as QHSE compliance, property rights and freezone authority regulations.

Policies and laws for online businesses

Laws

- Federal Law No. 1 of 2006 of Electronic Commerce and Transactions

- Federal Law No. 5 of 2012 on Combatting Cybercrimes and its amendment by the Federal Law No. 12 of 2016

- Federal Decree Law No. 2 of 2015 on Combating Discrimination and Hatred

- UAE Cyber Law

Policies

- Internet Access Management – Regulatory Policy – TRA

- Internet guidelines

- UAE official advertising guide

- The UAE Social Media White Papers – TRA

- Internet media regulations

Laws for all businesses

General

- Electronic Transactions and Commerce Law

- Commercial Transactions Law

- The Federal Law No. 4 of 1979 on Combating Commercial Fraud

- Federal Law No 20 of 2016 on the mortgage of movable property to secure debt

- Business laws in the UAE – Abu Dhabi government portal

- Business offences law – Abu Dhabi government portal

- Common Customs Law of the GCC States

- Guidelines, specifications, laws and manuals for tenders – the official portal of Abu Dhabi Government

- Protection of Intellectual Property – Abu Dhabi government portal

- UAE Trademark Law – Abu Dhabi government portal

- Emirates Securities & Commodities Authority and Market Law – Abu Dhabi government portal

- Electronic Transactions and Commerce Law – Abu Dhabi government portal

Laws for recruitment and employment

- The UAE Labour Law – Ministry of Human Resources and Emiratisation

- Ministerial Decree 764 of 2015: Standard Employment Contracts

- Minister of Labour’s Decree 765 of 2015 on conditions and rules for the termination of employment relations

- Ministerial Decree 766 of 2015 on the conditions and rules for granting a permit to a worker for employment with a new employer

- Resolutions and circulars – Ministry of Human Resources and Emiratisation

- Emiratisation Laws – Ministry of Human Resources and Emiratisation

- International agreements – Ministry of Human Resources and Emiratisation

Free trade agreements – Ministry of Economy

- Free trade agreements GCC EFTA FATA

- Free trade agreement GCC-Singapore FTA (GSFTA)

Central Bank of the UAE

- Laws related to anti-Money laundering and suspicious cases Unit – AMLSCU

- Laws of Islamic banks

- Major selected notices and circulars issued by UAE Central Bank to all other banks and financial institutions

Laws for private security companies – Ministry of Interior

- Federal Law No. 37 of 2006 concerning private security companies

- Cabinet Resolution No. 33 of 2008 regarding the application licensing fees for private security companies

- Ministerial Resolution No. 557 of 2008 abo the executive regulations of private security companies law

Laws from Securities and Commodities Authority

- Federal Law No. 4 of 2000 about the Emirates Securities & Commodities Authority and market

- Decision No. 13 of 2000 about the regulations regarding the functioning of the Securities and Commodities Authority

Safety, health, and environment regulations

- Mid-day break rule – Ministry of Human Resources and Emiratisation

- International agreements – Ministry of Human Resources and Emiratisation

- Laws and legislations – Ministry of Climate Change and Environment

- Rules and regulations – Federal Authority for Nuclear Regulation

- Environment laws – Environment Agency, Abu Dhabi

Taxation laws:

- Federal Decree Law No. 7 of 2017 on Excise Tax

- Federal Decree-Law No. (8) of 2017 on Value Added Tax

- Federal Law by Decree No. 13 of 2016 regarding the establishment of the Federal Tax Authority

These laws are what govern all businesses established in the UAE, be it somewhere like Ajman Media City Free Zone where the laws are lenient for businesses, or on the mainland.