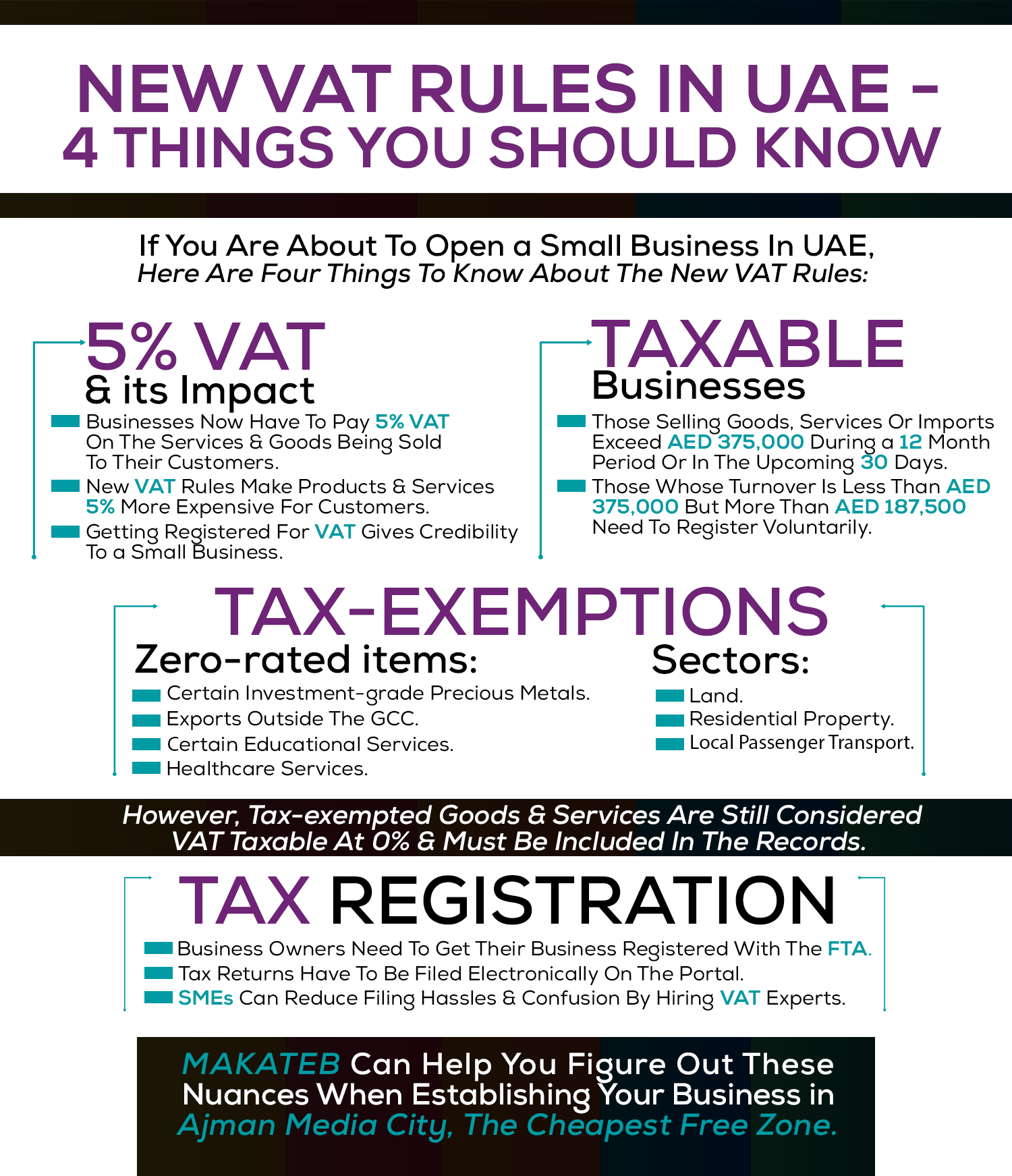

In January 2018, UAE introduced VAT– value-added tax at the standard rate of 5%. If we talk in terms of the economy of the country, including VAT registration in UAE is actually a good idea. Having said that, some business owners in the country are not happy about it.

The VAT rules at first might seem complicate, but if you know the following four things about VAT registration in UAE, life will become easier for you as a business owner. In addition, you would also get incremental information about Ajman Media City Free Zone:

1 – VAT is not for every company

Yes, you read that right. Only if your company has more than AED 375,000 each year in taxable imports and supplies, your company has to pay VAT. The assessment is done on the basis of two things; you have either exceeded that limit in the last 12-months, or you are expected to exceed the limit in the coming 30-days. To know whether you need to pay VAT, and if so, then how much, consult VAT experts to understand the nuances of VAT registration.

2 – Not all goods and services are subject to VAT

Some services and goods are exempt from tax. This means that your company doesn’t need to pay for VAT on these items. These items are label as zero-rated, and these items include; some investment-grade precious metals, export outside the GCC, and some educational services, healthcare services, etc. The sectors that are exempt from VAT are land, residential property and local passenger transport. Although the items mention above are exempt from VAT, these goods and services are still consider VAT taxable at 0%. In other words, you must include these zero-rated supplies in your VAT records.

3 – There are no plans to raise VAT

3 – There are no plans to raise VAT

This news is actually a good one for the people who are worried about paying and increment of the VAT tax. Yes, there are no plans for increasing the VAT beyond the current 5%. This has brought relief to medium-size businesses.

4 – VAT May Impact a Product or Service’s Affordability

Depending on who your customers are, charging them VAT can at times prove to be harmful to the sales aspect of your business. Let’s say you sell directly to customers, they might not be registered for VAT, so they can’t claim VAT against your services or products. This makes your products and services 5% more expensive for them.

Makateb is a premium business set-up service in UAE that helps individuals and firms establish their own businesses in UAE. It provides company formation, PRO and visa services through a variety of packages. Talk to our experts about establishing your business in Ajman Media City Free Zone.