Corporate consulting in uae The majority of the businesses in the UAE are own by foreign nationals, most of whom are settle in the UAE. Whether you keep a Freezone Ajman Business in consideration or one locate on mainland Dubai, there are high-level chances that an expat owns it. Living in the UAE is expensive and while it has its perks like a good standard of living and being near your business, some choose to stay in their own country. The main reasons that motivate to live outside the UAE despite owning a business here is to be surround by friends and family, and all that is familiar, or if their main business or other businesses are there.

Running a corporate consulting business from a foreign country can turn out to be an expensive decision. Being present physically in the office can be an advantage in times when quick decisions need to be taken.

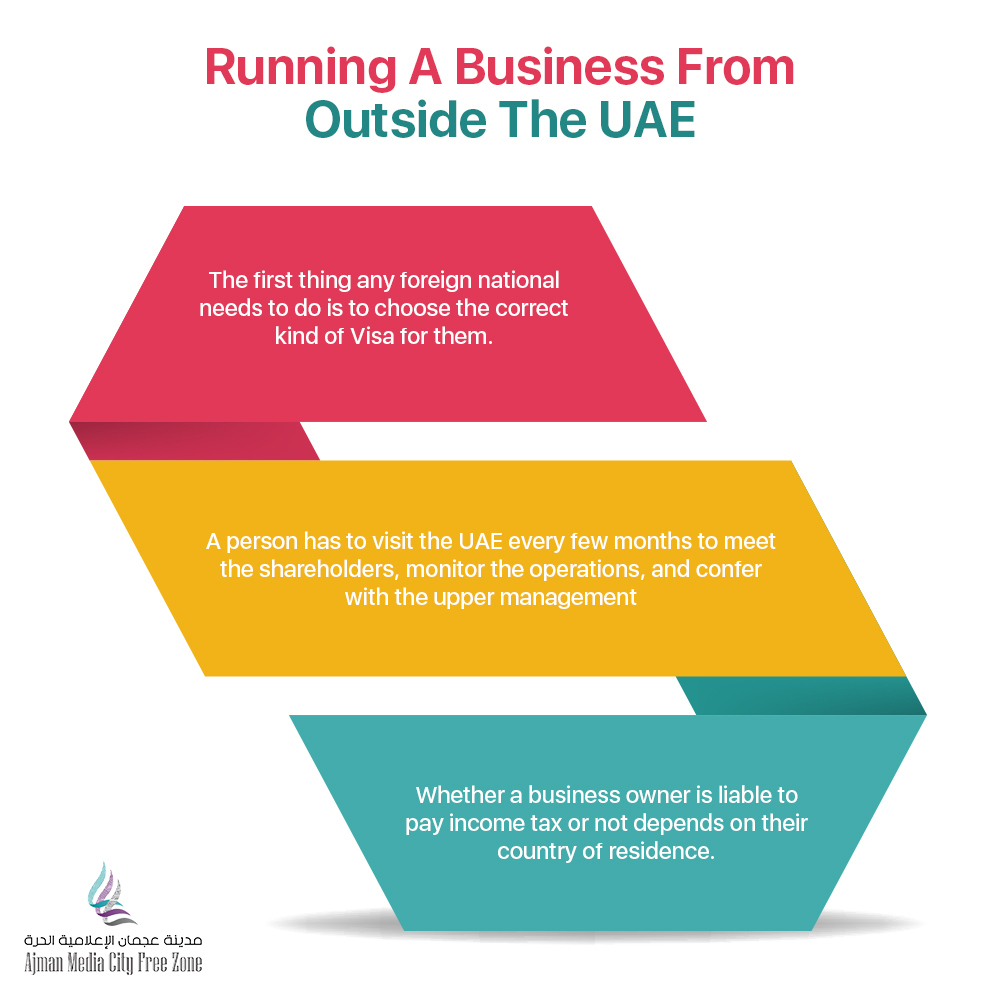

There a few things that a person should consider if they are planning to run a business from outside the UAE.

Time in UAE

The first thing any foreign national needs to do is to choose the correct kind of Visa for them. Each type of Visa has a different requirement, like a person with a residential Visa must visit the UAE at least once every 6 months. Similarly, there are different requirements and time restrictions, UAE Visa holders need to abide by. Therefore, it is best to know which Visa best suits your needs. If a person finds this inconvenient, they can always apply for a change in status. There are other options that better suit the needs of different people. However, one thing is for sure, a person has to visit the UAE every few months to meet the shareholders, monitor the operations, and confer with the upper management.

Income Tax

Whether a business owner is liable to pay income tax or not depends on their country of residence. If a person spends more than 6 months in the UAE, they are consider a tax resident, and since the income tax rate is set at 0% in the UAE, they do not have to pay a single penny. However, some countries consider factors like the location of your main corporate consulting business, if you own any other assets or have international bank accounts if your family is traveling along too and more.

Thus, the zero tax rule does not apply to everyone, and neither do the rules of Freezone Ajman or any other UAE Freezone. Nonetheless, one concession that the UAE provides is protecting business owners from paying double the taxes. The UAE has double tax agreements (DTA) drawn up with 100 countries, to determine which country is entitle to tax an individual on their worldwide income.

Second in Command

It is important to appoint a trust individual as the company’s Director or CEO. However, if this person is to run the company in your absence, they need a power of attorney. However, this person should not receive too much authority. Thus, certain roles need to be put on paper.

In short, there is a lot that business owners need to see to when it comes to running a company, especially if they aren’t physically present there, so a few significant decisions need to be made in order to smoothly run operations, whether from Ajman Media City Freezone or their homeland.