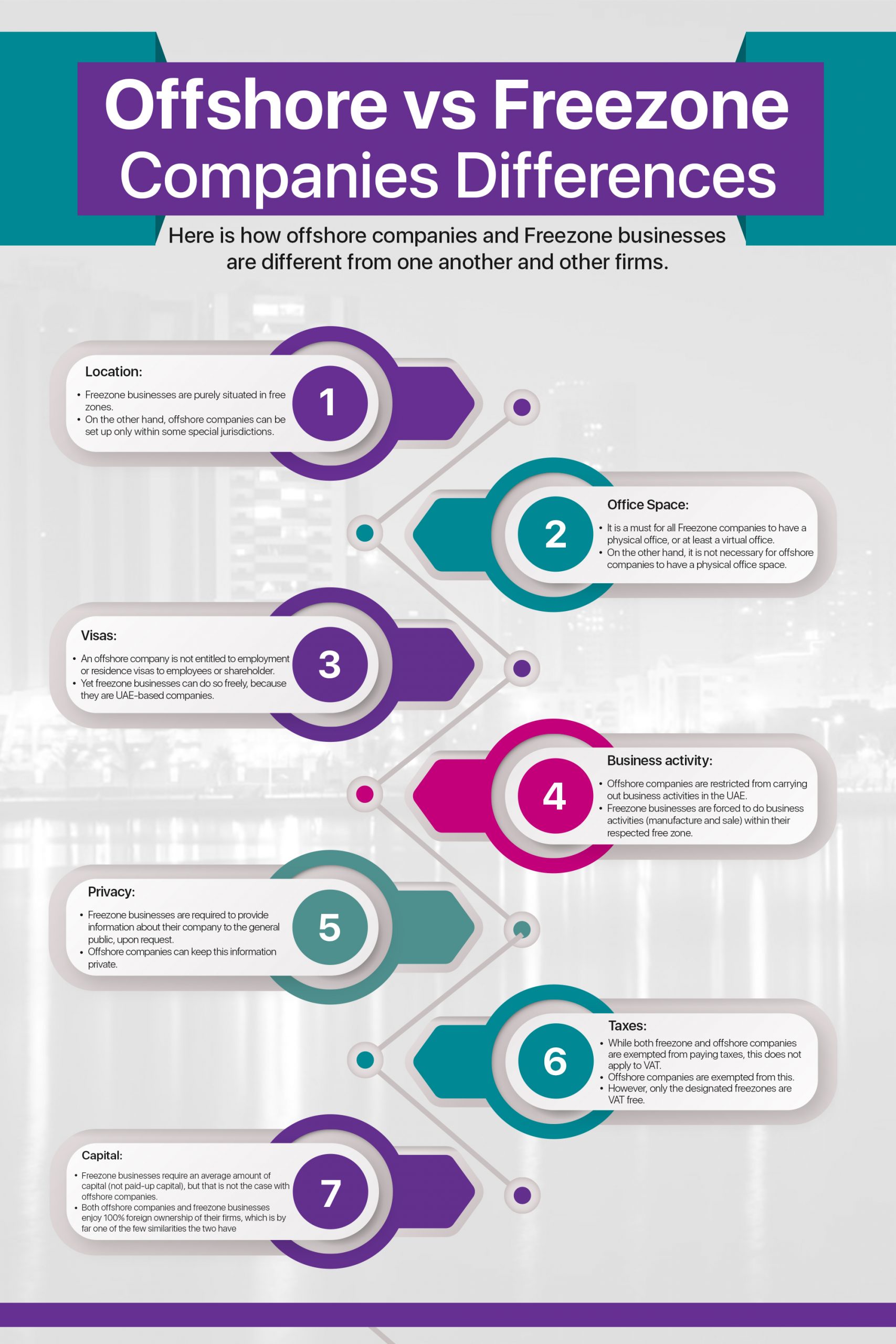

Offshore Companies ,UAE has a lot of different types of businesses and these are just two of them. Imagine Freezone companies are different from offshore ones, and their dissimilarity in a few features. Therefore, let’s find out how offshore company and Freezone businesses are different from one another and other firms.

Location:

Location:

The main dissimilarity between these two categories of business are their location. Freezone businesses are purely situate in free zones such as Ajman Media City Freezone. There are more than 40 freezones in UAE, and all of them are ideal locations for businesses due to their business-friendly laws and regulations. On the other hand, offshore businesses can be set up only within some special jurisdictions. However, the reason they are called offshore companies is because their business should be conduct only outside the registrar jurisdiction.

Office Space:

It is a must for all Freezone companies to have a physical office, or at least a virtual office. On the other hand, it is not necessary for offshore company to have a physical office space in the UAE.

Visas

An offshore company is not entitle to employment or residence visas to employees or shareholder. Yet freezone businesses can do so freely, because they are UAE-based companies.

Business activity

Offshore companies are restrict from carrying out business activities in the UAE, but are free to do business or to sell their good or service in another country. However, freezone businesses are force to do business activities (manufacture and sale) within their respect freezone. However, they can sell their goods and services outside their freezone (local and international), with a local distributor. Like a business locate in Ajman Media City Freezone.

Privacy

Freezone businesses are require to provide information about their company to the general public, upon request. This, however, is not the case with offshore companies.this companies have the luxury to keep the identify of their owner, shareholders and directors private.

Taxes

While both freezone businesses and offshore company are exempt from paying taxes, this does not apply to VAT. Offshore companies are exempt from this. However, only the designate freezones are VAT free. In other words, not all freezone businesses are exempt form VAT.

Capital

Freezone businesses require an average amount of capital (not paid-up capital), but that is not the case with offshore company, which require very little capital. This is because offshore company will not exactly set operations or lay down roots in the region. However, freezone businesses do need to set up their office and carry out all their business-relate activities, which is why they need more initial capital, whether they are establishing a business in Ajman Media City Freezone, or anywhere else.

Both offshore businesses and freezone businesses enjoy 100% foreign ownership of their firms, which is by far one of the few similarities the two have. Regardless, offshore businesses and freezone businesses are both different from one another.